Basic earnings per share ignores – Basic earnings per share (EPS) ignores certain factors that can affect a company’s true profitability, leading to potential misinterpretations. This article explores the limitations of basic EPS, alternative measures of earnings, and best practices for its use in financial analysis.

Understanding these limitations is crucial for investors and analysts to make informed decisions based on a comprehensive view of a company’s financial performance.

Definition of Basic Earnings Per Share (EPS)

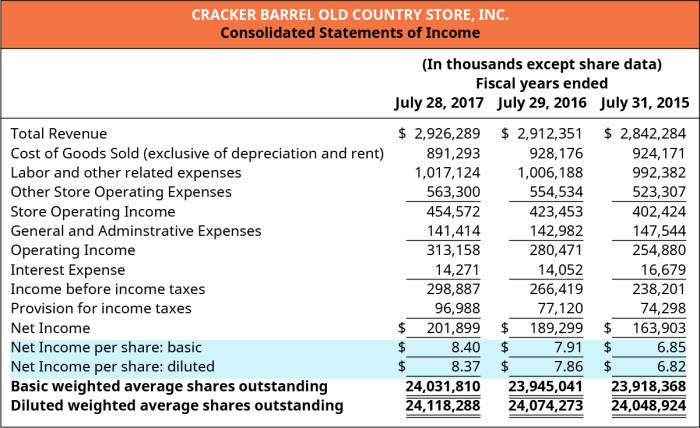

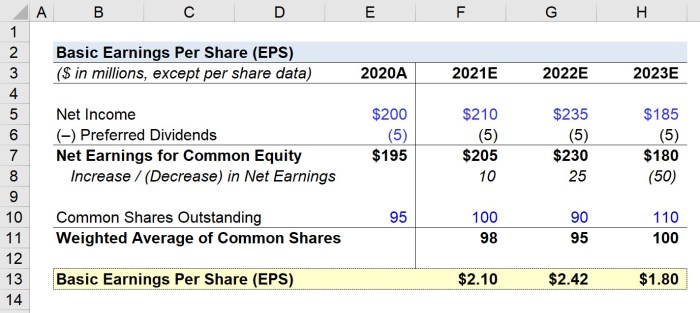

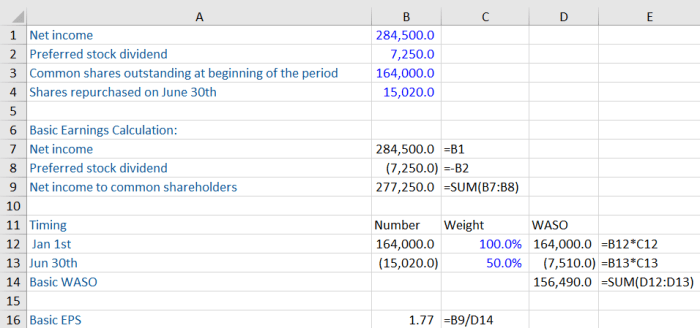

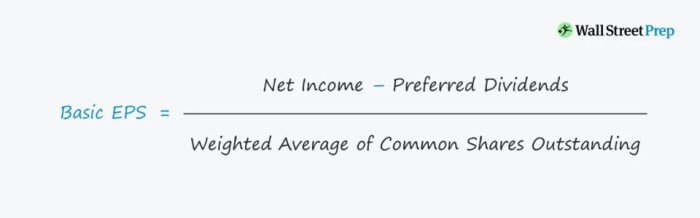

Basic earnings per share (EPS) is a financial metric that measures the portion of a company’s profit that is allocated to each outstanding share of common stock. It is calculated by dividing the company’s net income by the weighted average number of common shares outstanding during a specific period, typically a quarter or a year.

Formula for Calculating Basic EPS

The formula for calculating basic EPS is as follows:

Basic EPS = Net Income / Weighted Average Number of Common Shares Outstanding

Significance of Basic EPS

Basic EPS is a key indicator of a company’s profitability and is widely used by investors and analysts to evaluate a company’s financial performance. It provides insights into how effectively a company is using its resources to generate earnings for its shareholders.

Limitations of Basic EPS

While basic EPS provides a fundamental measure of a company’s earnings, it has limitations in providing a comprehensive view of a company’s profitability. Basic EPS ignores several factors that can impact the accuracy of the reported earnings per share.

Dilution

Basic EPS does not consider the potential dilution of earnings per share that may occur due to the issuance of additional common shares, such as through stock options or convertible bonds. This can lead to an overstatement of earnings per share, as it does not reflect the potential decrease in earnings per share if these additional shares are exercised or converted.

Complex Capital Structure, Basic earnings per share ignores

Basic EPS assumes a simple capital structure consisting of only common shares. However, many companies have complex capital structures that include preferred stock, convertible debt, or other hybrid securities. These complex structures can make it difficult to determine the appropriate number of shares to use in the EPS calculation, leading to potential inaccuracies.

Non-Recurring Items

Basic EPS does not adjust for non-recurring items, such as gains or losses from the sale of assets or discontinued operations. These items can significantly impact the reported earnings per share in a given period but may not be representative of the company’s ongoing performance.

Alternative Measures of Earnings

Basic earnings per share (EPS) is a widely used measure of profitability, but it may not provide a comprehensive view of a company’s earnings. Alternative measures of earnings, such as diluted EPS and comprehensive income, can offer a more complete picture of a company’s financial performance.

Diluted EPS

Diluted EPS is a measure of earnings per share that takes into account the potential dilution of earnings that could occur if all convertible securities, such as convertible bonds and convertible preferred stock, were converted into common stock. Diluted EPS is calculated by dividing the company’s net income by the sum of the weighted average number of common shares outstanding and the number of shares that would be issued if all convertible securities were converted.

Diluted EPS is generally considered to be a more conservative measure of earnings per share than basic EPS, as it takes into account the potential for additional shares to be issued in the future. However, diluted EPS can be more difficult to calculate than basic EPS, as it requires the company to estimate the number of shares that would be issued if all convertible securities were converted.

Comprehensive Income

Comprehensive income is a measure of a company’s total financial performance over a period of time. Comprehensive income includes all of the company’s revenues and expenses, as well as other changes in equity that are not included in net income.

Comprehensive income is often used to provide a more complete picture of a company’s financial performance than net income, as it includes items that may not be reflected in net income, such as unrealized gains and losses on investments.

Comprehensive income is not a substitute for net income, but it can provide additional insights into a company’s financial performance. Comprehensive income can be used to assess a company’s long-term profitability, as it includes items that may not be reflected in net income in the current period.

Impact of Ignoring Factors on Financial Analysis: Basic Earnings Per Share Ignores

Ignoring certain factors in the calculation of basic EPS can significantly impact financial analysis. This can lead to inaccurate conclusions or misinterpretations, potentially misleading investors and other stakeholders.

One example is ignoring the impact of convertible securities. If a company has issued convertible bonds or preferred stock, these securities can potentially be converted into common stock. This can dilute the number of outstanding shares and lower the EPS.

Failing to account for this dilution can lead to an overestimation of the company’s earnings.

Another factor that can affect EPS is stock options. Stock options give employees the right to purchase shares of the company’s stock at a set price. If the stock price rises, employees may exercise their options and purchase shares, which can also dilute the number of outstanding shares and lower the EPS.

Ignoring the potential dilution from stock options can lead to an overestimation of the company’s earnings.

Considering all relevant factors when analyzing a company’s earnings is crucial. Ignoring certain factors can lead to inaccurate conclusions and misinterpretations, potentially misleading investors and other stakeholders.

Best Practices for Using Basic EPS

Basic EPS is an appropriate measure of earnings per share when a company has a simple capital structure and no dilutive securities outstanding. It provides a straightforward and comparable metric for evaluating a company’s earnings performance over time and against industry peers.

Interpreting Basic EPS

When interpreting basic EPS, it is important to consider the following guidelines:

- Compare basic EPS to industry averages and peer companies to assess the company’s relative earnings performance.

- Analyze basic EPS in conjunction with other financial metrics, such as revenue growth, profit margins, and return on equity, to gain a comprehensive understanding of the company’s financial health.

- Consider the impact of non-recurring items, such as one-time gains or losses, on basic EPS to ensure an accurate assessment of the company’s ongoing earnings power.

Limitations of Basic EPS

While basic EPS is a useful metric, it has certain limitations:

- It does not consider the potential dilution of earnings from convertible securities or other dilutive instruments.

- It does not reflect the impact of changes in the number of shares outstanding due to stock splits or stock repurchases.

- It may not be representative of the company’s earnings per share in the future, especially if the company’s capital structure changes.

Essential FAQs

What is the primary limitation of basic EPS?

Basic EPS ignores the potential dilution of earnings caused by convertible securities, such as stock options and convertible bonds.

How can diluted EPS provide a more comprehensive view of earnings?

Diluted EPS considers the potential dilution of earnings by including all convertible securities in the calculation, resulting in a lower EPS value that reflects the potential impact on future earnings.

When is it appropriate to use basic EPS in financial analysis?

Basic EPS can be used when there are no significant convertible securities outstanding or when the potential dilution is immaterial to the analysis.